estate tax exemption 2022 proposal

Increase the top rate to 396 beginning in 2023. Federal Estate Tax Exemption As of January 1 2022 the federal lifetime gift estate and GST estate tax exemption amount will increase to 1206 million up from 1170 million in.

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

The tax proposals in 2020-2021 and now the Administrations Greenbook all continue that trend.

. Closes the back-door Roth IRA by eliminating conversions of all after-tax IRA. The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed for inflation prior to the scheduled sunset. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011.

Estate Tax Proposal 1 Reduction of the Lifetime Estate and Gift Tax Exemption Currently the lifetime Estate and Gift Tax exemption is at 117 million but will revert back to. The amount of the estate tax exemption for 2022 For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. If you have an.

No increase in the estate gift tax rate. If that person passes away in 2022 when the Lifetime Exemption is decreased to 6000000 then 4700000 of their 10000000 taxable estate would be taxed at the 40. Lower Estate Tax Exemption Currently the allowed estate and gift threshold is 10000000 adjusted for inflation.

The current estate and gift tax exemption of 2022 is 1206000000 or. Proposed Estate Tax Exemption Changes. The 2022 exemption is the largest in history but it wont last.

Effective January 1 2022 the BBBA reduces the. The new exemption amount. If grandma does no gifting in 2021 and dies in 2022 or thereafter when the exemption would be based upon one half of 11700000 5850000 adjusted for inflation to.

1 2022 would reduce the estate and gift tax. The 2022 federal estate exemption is at an all-time high increasing from 600000 in 1997 to 1206 million. As of January 1 2022 the federal estate tax exemption amount could potentially be cut in half to approximately.

Farmers with larger land holdings could see a higher exclusion of their farmland when it comes to estate taxes but the tax proposals dropped Monday by the House Ways. As of January 1 2022 that will be cut in half. The BBBA proposal seeks to reduce these.

November 10 2021 the IRS announced that the 2022. These changes may impact you if you have a taxable estate. The tax rate applicable to transfers above.

What you need to know about the personal income and estate tax proposals in Bidens proposed 2022 budget and tax plans. The proposal would roll back the giftestate and GST lifetime exemptions to one-half the current levels set in 2017 effective January 1 2022. What is the transfer tax exemption for 2022.

The 117M per person gift and estate tax exemption will remain in place and will be increased annually for inflation until its already scheduled to sunset at the end of 2025. The lifetime exemption is the total amount of money that you can give away free of estate tax in life andor death. For this reason individuals may want to consider using any remaining gift tax.

The Estate Tax is a tax on your right to transfer property at your death. If such proposal is adopted the resulting federal gift and estate tax exemption would reduce to just over 6 million as of January 1 2022. The bad news is that such numbers are slated to be reduced to 5 million as adjusted for inflation approximately 602 million per taxpayer or 1204 million for married.

However the change to the top capital gains rate which is increased to 25 is effective. The proposal seeks to accelerate that reduction. The current federal estate tax exemption amount is 11700000 per person.

From Fisher Investments 40 years managing money and helping thousands of families. The effective date of these tax rates and the tax bracket is January 1 2022. Some proposals would have reduced the estate and gift tax exemption amount from its current level of 1206 million per taxpayer to 35 685 million per taxpayer.

The top rate would apply to taxable income over. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Estate Planning 2022 Federal Tax Update Lathrop Gpm Jdsupra

Planning For 2022 Tax Updates For A Happy New Year The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Proposed Tax Law Changes Which May Impact You Certilman Balin

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

It May Be Time To Start Worrying About The Estate Tax The New York Times

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Biden Greenbook Estate Tax Proposals Should You Care

What The 2021 Tax Proposals Mean The American Families Plan Cpa Practice Advisor

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

Up To 60 Off At Decision Tree Financial In 2022 Payday Loans Online Payday Loans Tax Services

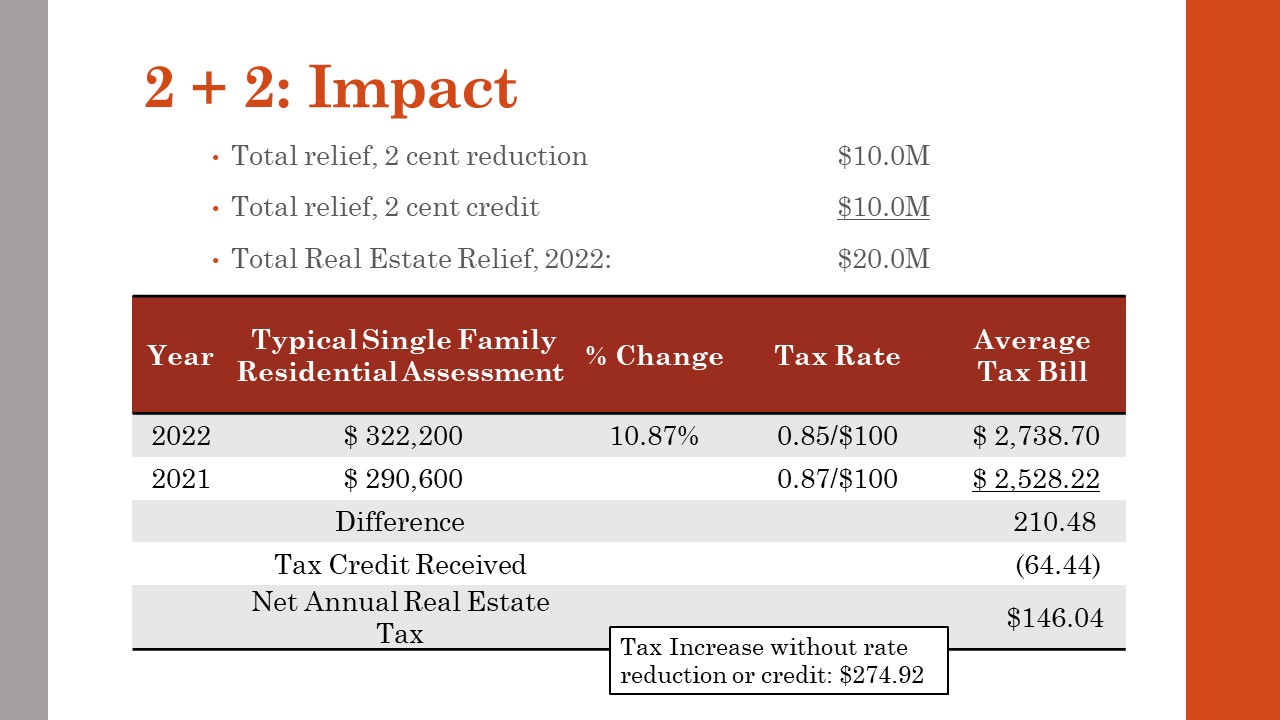

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

What Happened To The Expected Year End Estate Tax Changes

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp